Gulf Markets Decline Amid Trade War Fears

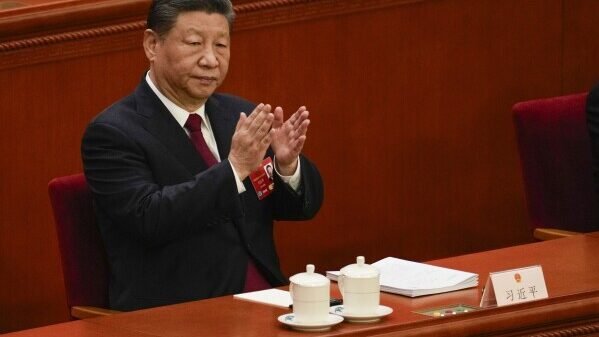

Major Gulf markets have experienced significant declines in recent weeks, driven by concerns over escalating trade tensions between global economic powers. As the U.S.-China trade war intensifies, regional markets in the Gulf have been caught in the crossfire of these global economic shifts. The uncertainty surrounding international trade agreements and the potential for further tariffs has caused widespread concern among investors in the Gulf region, leading to decreased confidence and a subsequent drop in stock prices. These developments reflect broader regional anxieties about the stability of global trade and its impact on the Gulf’s economic outlook.

Trade War Concerns Spill Over to Gulf Markets

The ongoing trade war between the U.S. and China has far-reaching implications beyond the immediate countries involved, with markets across the globe, including those in the Gulf, feeling the effects. The imposition of tariffs and the uncertainty about future trade policies have made investors cautious, particularly in markets that are heavily dependent on global trade and oil prices. The Gulf region, with its close ties to global trade networks and reliance on oil exports, is particularly vulnerable to these trade disruptions. As trade tensions escalate, Gulf markets are reacting to the potential for reduced demand, higher production costs, and geopolitical instability.

Oil Prices Under Pressure Amid Trade Tensions

One of the key factors contributing to the decline in Gulf markets is the volatility of oil prices. As a major exporter of oil, the Gulf economies are highly sensitive to fluctuations in global oil prices, which are influenced by the broader economic environment, including trade tensions. The U.S.-China trade war has created uncertainty in global markets, leading to concerns about reduced demand for oil and other commodities. As a result, oil prices have come under pressure, further affecting the profitability of Gulf-based oil companies and leading to declines in their stock prices. This instability in oil prices has had a direct impact on the region’s markets, which are closely tied to the energy sector.

Investor Sentiment and Market Volatility

Investor sentiment in the Gulf region has been significantly impacted by the growing fears of an economic slowdown due to escalating trade tensions. As global markets become more volatile, Gulf investors are becoming more risk-averse, leading to a retreat from equities and other riskier assets. The uncertainty surrounding trade policies, combined with the pressure on oil prices, has created a sense of unease in Gulf markets. Investors are hesitant to make long-term commitments in an environment where the future of global trade and economic stability remains uncertain. This shift in sentiment has contributed to market declines across the Gulf region, particularly in key stock indices.

Regional Economic Stability at Risk

The economic stability of the Gulf region is increasingly being called into question due to the ripple effects of global trade tensions. The Gulf economies, while diverse, are heavily reliant on both oil exports and international trade. The region has enjoyed economic growth over the past few decades, but with the current trade disputes and the potential for reduced global demand, that growth could be jeopardized. Key industries, including oil and gas, construction, and financial services, could all face challenges if trade tensions continue to rise. As trade disruptions affect global supply chains and investor confidence, the risk to the region’s economic stability grows, fueling concerns about long-term growth prospects.

Policy Responses to Mitigate Economic Downturn

In response to the declines in market performance and concerns about economic stability, Gulf governments have been considering various policy measures to mitigate the downturn. Efforts to diversify the region’s economies away from oil dependence have been ramped up, with investments in non-oil sectors such as tourism, technology, and financial services. Additionally, central banks in the region may consider monetary easing or other financial measures to support liquidity in the markets. However, while these measures could provide some relief, the success of these policies will largely depend on the resolution of global trade tensions. Until the trade conflict is addressed, the Gulf’s economic prospects remain uncertain.

Looking Ahead: Gulf Markets and Global Trade Dynamics

Looking ahead, the Gulf region’s markets will continue to be influenced by the evolving dynamics of global trade. If the trade war between the U.S. and China intensifies, or if new trade restrictions are imposed, Gulf markets could face further volatility and economic challenges. However, if global trade tensions ease and oil prices stabilize, the region could see a rebound in market performance. The key to the Gulf’s economic future lies in its ability to navigate these challenges, adapt to shifting trade landscapes, and continue its efforts to diversify its economy. As the global economic outlook remains uncertain, the Gulf will need to remain agile and resilient in the face of these ongoing trade challenges.

Conclusion: Trade Fears and the Gulf Region’s Economic Outlook

In conclusion, Gulf markets have faced significant declines amid growing concerns over escalating trade tensions between global economic powers. The uncertainty surrounding global trade, coupled with the volatility of oil prices, has raised alarms about the region’s economic stability. While the Gulf economies are taking steps to mitigate the impact of these concerns, the outcome of ongoing trade disputes will play a crucial role in shaping the future of the region’s markets. As trade wars continue to disrupt global supply chains and investor sentiment, the Gulf region will need to adapt to these challenges and remain focused on diversifying its economy to ensure long-term growth and stability.